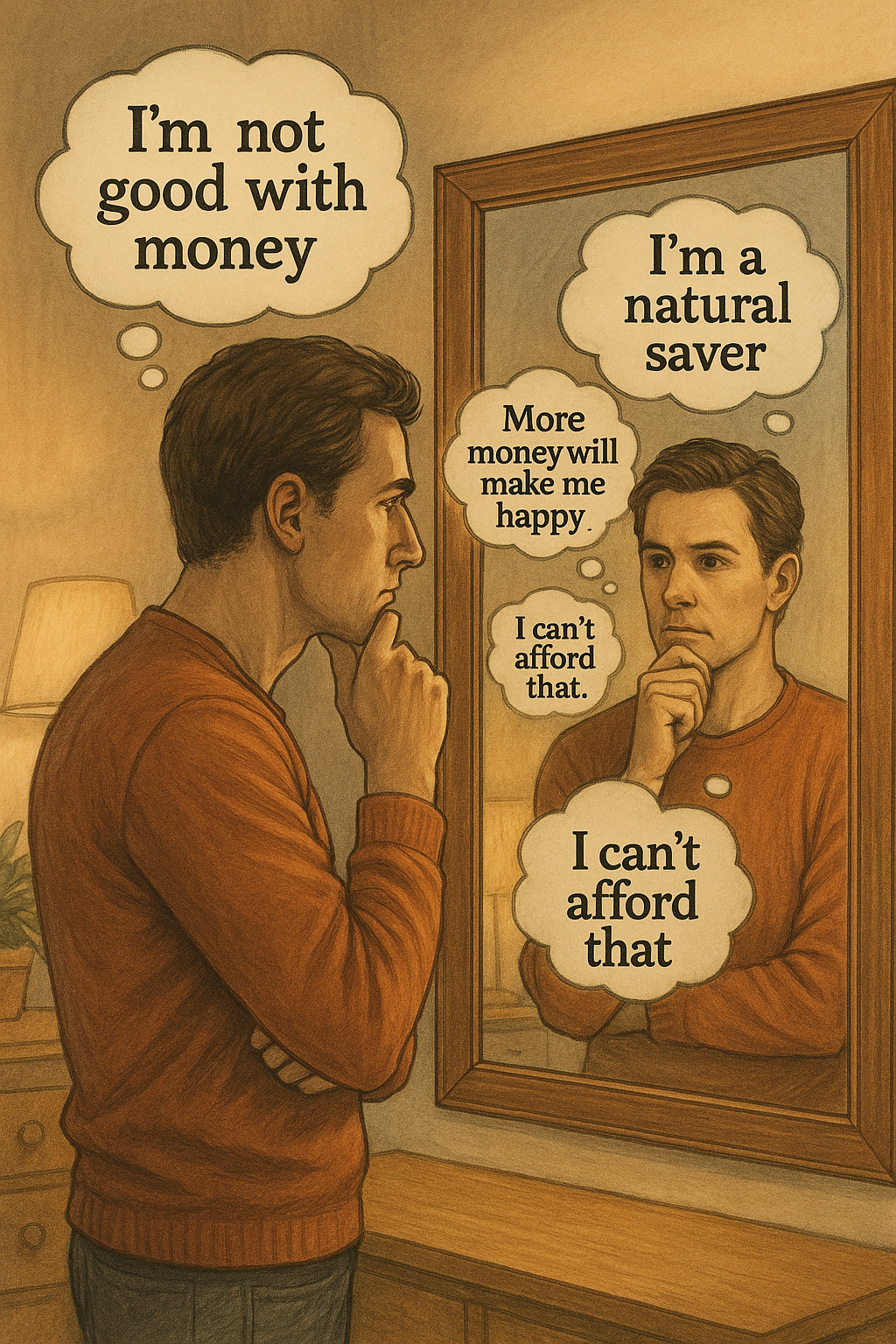

What if your biggest money problem isn’t the math, but the mirror?

When most people think about money management, they immediately picture budgets, spreadsheets, and calculators. But the most powerful influence on your financial decisions might not be numerical at all—it’s psychological. Your financial identity, or how you perceive yourself in relation to money, is quietly shaping your habits every day.

What is Financial Identity?

Your financial identity is the set of beliefs you hold about yourself and your ability to manage, earn, spend, and grow money. These beliefs are often internalized early in life and become the foundation for how you behave financially. Statements like “I’m not good with money” or “I’m a natural saver” aren’t just passing thoughts—they’re identity anchors.

Common Money Scripts

Financial therapists often talk about “money scripts”—core beliefs around money that are usually subconscious. Here are a few examples:

Money Avoidance: Belief that money is bad or that rich people are greedy.

Money Worship: Belief that more money will solve all problems.

Money Status: Self-worth tied to net worth.

Money Vigilance: Strong focus on saving and secrecy about finances.

Identifying your dominant script is a critical first step to understanding your financial behavior.

How Beliefs Shape Behavior

Your financial identity influences not just how you spend, but how you save, invest, and even talk about money. If you identify as “bad with money,” you may avoid managing your budget or checking your accounts, reinforcing the identity. If you believe you’re a “hustler,” you may pursue risky ventures without proper planning.

These beliefs function like auto-pilot: until you consciously reprogram them, they steer your financial ship.

Strategies to Rewrite Limiting Narratives

- Name the Narrative: Write down your most common money thoughts.

- Challenge the Belief: Ask yourself, “Is this always true?”

- Find Counterexamples: Reflect on times you managed money well.

- Create a New Identity Statement: Replace “I’m terrible with money” with “I’m learning to manage money wisely.”

- Reinforce with Action: Take small, consistent steps aligned with your new identity.

Real-Life Example

Marisol grew up in a household where money was tight and rarely discussed. As an adult, she identified as someone who “just wasn’t good with money.” After racking up credit card debt, she began journaling about her beliefs and discovered deep-rooted shame and fear. By shifting her identity from “financially irresponsible” to “financially aware and improving,” she started tracking expenses and paid off $5,000 in debt within a year.

📥 Download the Free ‘Financial Identity Reflection Sheet’ to uncover your own money scripts and begin shifting toward a healthier financial mindset.